Economic Progress

Having inherited an economy careening toward a second Great Depression, the Administration acted aggressively to arrest the crisis, restart growth and job creation, rebuild our economy on a stronger long-term foundation, and expand opportunity for all Americans.

Stabilized an Economy in Crisis

The Obama Administration took steps to help the hardest-hit Americans. Without the Recovery Act’s boost to household incomes, the poverty rate would have risen an additional 1.7 percentage points — which translates into about 5.3 million additional people that would have slipped into poverty in 2010.

The Administration provided tax relief that gave the typical American family a tax cut of $3,600 over the first four years of the Administration — helping to restart job growth — and made important tax cuts permanent for working families and families with college students.

Additionally, the Administration increased benefits and expanded access to the Supplemental Nutrition Assistance Program (SNAP), formerly known as food stamps lifting more than 500,000 households out of food insecurity.

Saved the American Auto Industry

The Obama Administration required that Chrysler and General Motors (GM) adopt viable restructuring plans in exchange for temporary federal loan support, including building more fuel efficient cars.

On December 19, 2014, Treasury announced that it had exited the last Troubled Asset Relief Program (TARP) equity investment under the Auto Industry Financing Program. The auto industry has fully exited the temporary federal programs that supported them, repaying the American taxpayer every dollar and more of what the Obama Administration committed.

Stabilized a Financial Sector in Crisis

The Treasury invested approximately $245 billion across five bank programs. Each of these programs was established to accomplish different goals as part of the overall effort to stabilize America’s banking system. Because of the aggressive response, the financial system stabilized and Treasury has recovered $275 billion, a nearly $30 billion positive return to the taxpayer. Additionally, the Administration launched programs to restart crucial lending markets for student and auto loans, other forms of consumer credit, housing, and small businesses.

“ Now is the time to act boldly and wisely — to not only revive this economy, but to build a new foundation for lasting prosperity.”

–President Barack Obama, Address to Joint Session of Congress, February, 24, 2009

Invested in Education

The Obama Administration catalyzed significant state education reforms to adopt higher academic standards to prepare students for college and careers, which 49 states and the District of Columbia have done. Additionally, the Administration invested in great teachers and leaders, and turned around low-performing schools through $4 billion in Race to the Top competition. Following these reforms, the high school graduation rate reached its highest level ever recorded, dropout rates fell sharply for low-income and minority students, and since 2008, college enrollment for African-Americans and Hispanics has increased by more than one million students.

May 11, 2012

Helped Responsible Homeowners Stay in Their Homes

President Obama made it easier for responsible homeowners to stay in their homes — avoiding foreclosures that would have hurt them and the economy and helping underwater homeowners refinance. In all, more than 10 million mortgage modification and other forms of mortgage assistance were completed to help mitigate the foreclosure crisis.

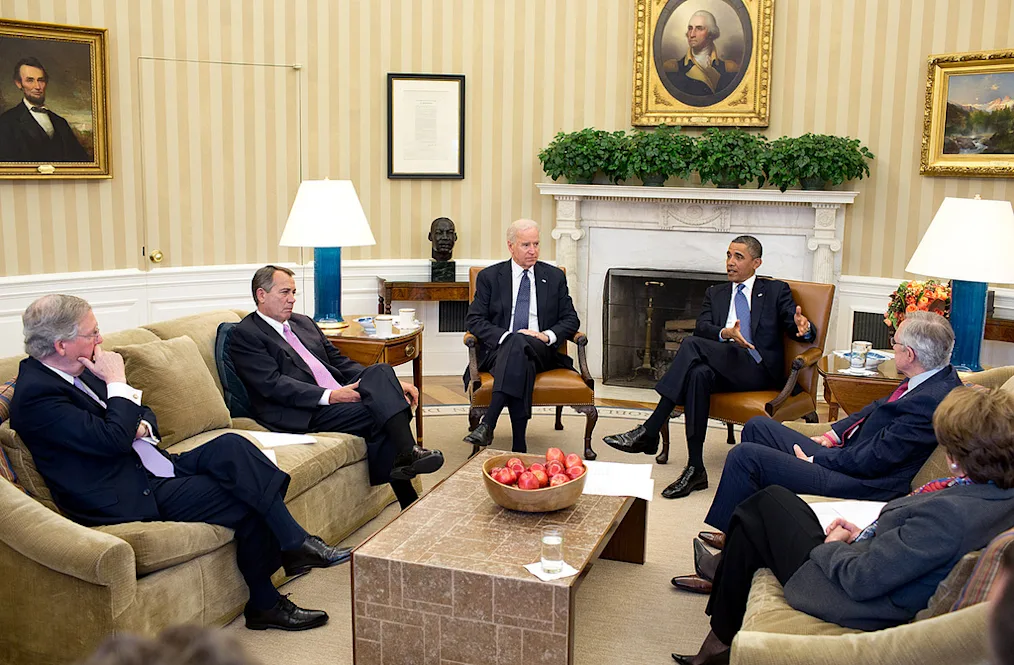

January 2, 2013

Made the Tax System Fairer

The Obama Administration made permanent tax cuts for 98 percent of Americans as part of the bipartisan fiscal cliff agreement in January 2013, while allowing costly tax cuts to expire for those with the highest incomes — which will reduce deficits by more than $800 billion over the next ten years.

Reformed Wall Street

The Obama Administration established the Consumer Financial Protection Bureau (CFPB) to hold financial institutions accountable and protect consumers from the types of abuses that preceded the crisis. Since its creation, this new independent watchdog has established safer national mortgage standards to better determine a borrower’s ability to repay over the long term, launched new transparency requirements that clearly spell out interest rates and payments, and subjected credit reporting agencies, debt collection agencies, and payday lenders to federal supervision for the first time.

The Administration also adopted the Volcker Rule to prohibit banks from risky proprietary trading and from sponsoring investment funds that are unrelated to core banking activities.

Fought for Fair Pay for All Genders

President Obama signed the Lilly Ledbetter Fair Pay Act, empowering workers to recover wages lost to discrimination by extending the time period for parties to bring pay discrimination claims, and took other steps helping to shrink the gender pay gap by more than 10 percent.

Additionally, he signed an April 2014 Executive Order that prohibits federal contractors from discriminating against employees who choose to discuss their compensation, further strengthening equal pay laws.

The Right to Equal Pay for Equal Work

Helped Unemployed Americans Get Back to Work

The Obama Administration worked with over 300 businesses, including 80 from the Fortune 500, to adopt recruiting and hiring practices to expand pathways to jobs for Americans who have been unemployed for 6 months or longer, and released grants that have trained nearly 5,000 long-term unemployed people for jobs in the past two years.

As more jobs are created, it was critical that Americans with skills, experience, and a desire to work would have every opportunity to get back to work to maximize the full potential of our talent pool. That’s why the White House partnered with employers to ensure that the long-term unemployed would have a fair shot at the same opportunities as other job-seekers. From the time businesses responded to the President’s call to action in January 2014 through November 2016, the long term unemployment rate was cut in half, accounting for roughly two-thirds of the total drop in unemployment.

January 9, 2015

Launched a New Manufacturing Network

The Obama Administration launched Manufacturing USA, which invests in U.S. leadership in emerging manufacturing technologies critical to our future competitiveness. Each manufacturing hub is designed to build U.S. leadership and regional excellence in critical emerging manufacturing technologies by bridging the gap between early research and product development; bringing together companies, universities, and other academic and training institutions, and federal agencies to co-invest in key technology areas that can encourage investment and production in the United States; and serving as a ‘teaching factory’ for workers, small businesses, and entrepreneurs looking to develop new skills or prototype new products and processes.

Helped Small Businesses Get Back on Track

President Obama used proceeds from the Troubled Asset Relief Program (TARP) to stabilize banks that lend to small businesses, and his Administration established two new small business credit programs—the State Small Business Credit Initiative and the Small Business Lending Fund.

Additionally, his Administration focused on strengthening small businesses by signing into law 18 tax cuts for small businesses, ranging from 100% expensing to the small business health tax credit, to the temporary tax exclusion of capital gains from key small business investments.

Supported the FCC’s Net Neutrality Decision

President Obama supported the FCC’s “net neutrality” decision to adopt the strongest rules possible to ensure Internet Service Providers (ISPs) cannot become gatekeepers to the Internet’s content or create paid fast lanes for access to the best services.

President Obama's Statement on Keeping the Internet Open and Free

Reduced Unemployment Among Veterans

In August 2011, President Obama called on Congress to enact tax credits that will help get veterans back to work. The Returning Heroes Tax Credit provides businesses that hire unemployed veterans with a maximum credit of $5,600 per veteran, and the Wounded Warriors Tax Credit offers businesses that hire veterans with service-connected disabilities with a maximum credit of $9,600 per veteran.

These tax credits were included in the American Jobs Act and were signed into law by President Obama on November 21, 2011.

Learn more about the Obama Administration

Browse the story of President Obama’s administration and the Obama family’s time in the White House.

Explore by Topic or Era